As a frequent traveler, I always found myself finding exchange companies to convert my money into local currency. While it might be a quick and easy process in a few countries, the majority of the time I would be stuck in long lines where people would waste time. That is when I decided to look around for options that can allow me to pay when traveling abroad and I came across DZING.

DZING finance services are quite better than others since they provide you with amazing luxury and freedom to make payments in a different country. In my DZING review, I’ll share my experience and the things that I liked about this platform. So, without further ado, let’s get right into it!

Amazing User Interface

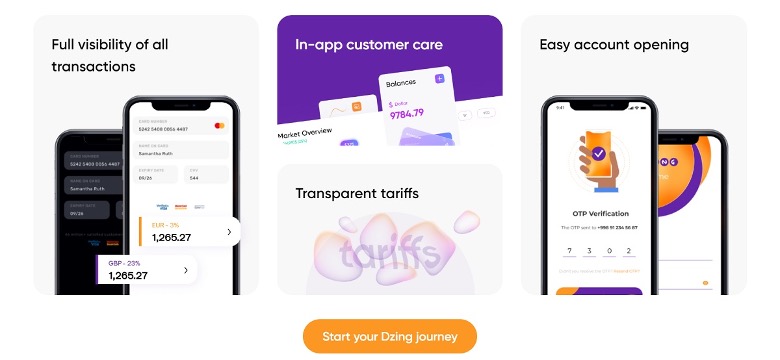

The thing that I liked the most about DZING is that it has a very easy-to-use application that can help you navigate through its amazing features. You would get instructions when first registering for the app to know how you can leverage and make the out of DZING’s services. This way, you can easily use the application to make payments in another nation.

Most importantly, it saves you from the time and hassle that would have gone into understanding and using a complex mobile app. In the wake of digital transformation, customer experience is everything. So, if an online service provider fails to provide their users with an app or online platform that is user-friendly, then they would be putting their sustainability at stake. This is something that DZING understands and places a huge emphasis on improving the overall user experience.

Different Types of Accounts

Another great thing that I would like to mention in the DZING app is that you can get different types of accounts from this platform. As a result, it can improve your overall traveling experience while giving you the ease to choose from the options you need according to your preference. Firstly, there is the traditional physical card which you can carry around and make payments easily.

Then, there is the online card that you can use to make payments through your application. Lastly, there is the disposable card that would only be valid for a specific timeframe or transactions. This way, you can ensure that your card isn’t used by someone else. You can review the annual fees and the features that the DZING service provider gives for choosing each card option.

Then, there is the online card that you can use to make payments through your application. Lastly, there is the disposable card that would only be valid for a specific timeframe or transactions. This way, you can ensure that your card isn’t used by someone else. You can review the annual fees and the features that the DZING service provider gives for choosing each card option.

Multi-Currency Accounts That Make Payment Options Easy for You

This DZING review is simply incomplete without mentioning the multi-currency accounts that you can get from this amazing service provider. If you’re a business owner that has operations in different parts of the world or a traveler that wants to explore different regions, then this option is the optimal choice for you.

You have the freedom to travel from one place to another without having to review the exchange firms in that particular country before your journey. This amazing service allows you to streamline the overall traveling experience since you can focus on exploring other things rather than just going around exchanging the currency. Simply choose the items that you like and then pay for those things using the DZING app.

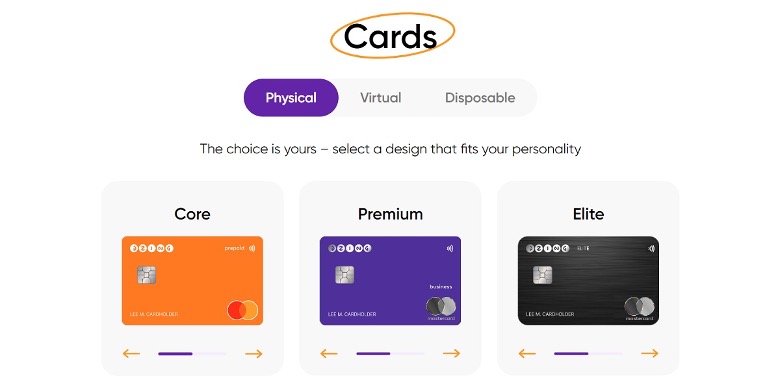

Choose From the Variety of Cards

For the last feature of my DZING review, I would like to mention the amazing range of cards that you can get from this service provider. There are three main types of cards that you can get from DZING: physical, virtual, and disposable. All the cards have their own unique set of characteristics that you can choose from according to your needs and preferences. Most service providers give a single option to all their users which might not be a suitable option for every user.

But that is not the case with DZING since it provides different options to users. For the standard physical card, the platform gives you three options that you can choose from. The first is the Core business card, followed by the Premium and Elite business cards. All three cards have their own set of features that you can choose from, depending on your needs. But keep in mind that the annual charges and the fees would vary. So, consider that option before choosing any card type.

Final Word

Choosing the right financial service provider can help you streamline your overall journey. It saves you from spending time at the exchange companies. Most importantly, you can purchase any item that you want and shop around just like you do in your home country. These features are just a few of the plethora of other characteristics and attributes of this platform. There are many more that you can get from DZING that I want you to personally find out by availing of its amazing services.